A Kirby classic is coming to the growing collection of Game Boy Advance games available with a Nintendo Switch Online + Expansion Pack membership ...

News

Troll Lord Games is now reprinting and selling several tabletop roleplaying game titles by the late Gary Gygax ...

President Joe Biden invoked the spirit of the late Sen. John McCain while denouncing "MAGA extremists" as a threat to democracy, during a speech Thursday at...

The Creator is more action-packed than thought-provoking, which is a shame given the prevalence and timeliness of AI in the news ...

With Gallifrey at war, whoever runs the War Room will determine the future of the Time Lords ...

The American Lung Association gave Maricopa County an F rating for its air quality. This poor air quality has led to an increase in health concerns...

Disney shared a new trailer, poster and images showcasing the epic musical comedy “Wish,” which opens in U.S. theaters on Nov. 22 ...

Not much survives of "The Celestial Toymaker" from 1966, as the BBC then didn't do much to archive TV programs, but you can watch the grand finale...

The Netflix anime based on Devil May Cry, Hideki Kamiya's Capcom action-adventure game franchise, finally gets a teaser ...

Richter Belmont rises, with vampires in the French Revolution ...

Our story begins: baby Richter meets Olrox. This clip represents the Cold Open of Castlevania: Nocturne - premieres Sept. 28 on Netflix.

A number of popular series from Marvel Studios and Lucasfilm will be available on Collector’s Edition 4K UHD and Blu-ray ...

You can now get a fresh print version of David "Zeb" Cook's 1981 Expert Rulebook for Basic Dungeons & Dragons ...

Watch the trailer for Scooby-Doo! and Krypto, Too!

Halloween Wars Season 13 takes the cake, and sugar, and pumpkins, back to basics ...

Big Finish Productions’ series of Eleventh Doctor audio dramas is getting a surprise bonus episode ...

The new trailer for Doctor Who's 60th anniversary specials features Neil Patrick-Harris as the Toymaker ...

I don't want to make something easily scrolled away. I don't want to make decor. I want to tell stories and create things that have legs ...

Learn all about Mario’s latest 2D side-scrolling adventure, including worlds, playable characters, power-ups, Wonder effects, and so much more!

Sam Worthington burst onto the international cinema scene with his breakthrough role in James Cameron's epic science fiction film, "Avatar." Since then, he has...

Dumb Money is the story of how a bunch of Reddit influenced investors teamed up to buy GameStop stock ...

Star Trek may take itself too seriously, but these new cartoons take the successful Lower Decks formula too far ...

The Hunger Games: The Ballad of Songbirds & Snakes is in theaters Nov. 17, 2023 ...

Billie Piper returns as Rose Tyler for three new full-cast audio adventures as she searches for her Doctor ...

Meet the 12 finalists in the running for the 2023 National Toy Hall of Fame ...

It has been one year since the fall of Starlight Beacon ...

Street Fighter 2010: The Final Fight is one of those games you either love or hate ...

The real thrill at Colorado Springs Comic Con came when I met a LEGO club and saw the coolest MOC ever ...

Among the many lessons I've learned from Batman over the years, these are the most prominent ...

Aquaman and the Lost Kingdom will surface in theaters Dec. 20 ...

SCOTTSDALE – The Arizona Coyotes keep knocking on doors to find their new home, and while no one has answered yet, the organization believes its latest stop...

A brand-new trailer for Final Fantasy VII Rebirth debuted at State of Play ...

Nintendo pulled back the curtain during the most recent Nintendo Direct video presentation and unveiled details on a wide variety of games that will set the...

Howl’s Moving Castle will be in theaters again this month as the penultimate entry in Studio Ghibli Fest 2023.

The Ashoka series self-spoiled a major character reveal ...

Disney and Pixar’s “Elemental” begins streaming on Disney+ Sept. 13 ...

Hercule Poirot is back in A Haunting in Venice, the third of director Kenneth Branagh’s series of murder mystery films based on the Agatha Christie stories ...

It turns out you don't have to wait until later in the year for another dose of David Tennant in Doctor Who ...

The hit film inspired by the classic theme park attraction will begin streaming on Disney+ and arrive at digital retail on Oct. 4 and Blu-ray/DVD Oct. 17 ...

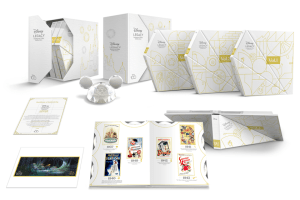

This special collection features a stunning array of Disney Animation and Pixar classics including Bambi, Sleeping Beauty, The Lion King, Toy Story, Frozen and...

Original is better than good.

Star Trek: The Animated Series is coming to the Star Trek Adventures roleplaying game ...

Happy 57th birthday, Star Trek! (Absolutely nothing new was announced ...)

Relive some of the most iconic moments from Star Trek: Picard's epic final season ...

"Goosebumps," the chilling new series inspired by R.L. Stine's worldwide bestselling Scholastic book series, is set to debut across both Disney+ and Hulu on...

ASU men’s basketball will open its upcoming season in Chicago at the Barstool Sports Invitational on Nov. 8.

Will The Boy and the Heron be Hayao Miyazaki's final film?

Nintendo quietly added four more classic titles to the Nintendo Switch Online service today ...

Peter Davison, Janet Fielding and Sarah Sutton are joined by a fab cast, including Fenella Woolgar and Niky Wardley ...

Nintendo is kicking off the holidays early this year by announcing a season of offerings with something for everyone ...

When you default to the dream, it gets that much closer to reality.

Look out! It’s raining Inklings and Octolings as the new season of the Splatoon 3 game for the Nintendo Switch family of systems splashes onto the scene. Check...

Get ready to jump into the unexpected with Super Mario Bros. Wonder – the next evolution of Mario fun and the first 2D side-scrolling Super Mario Bros. game in...

When the night shift starts, the nightmare begins. Watch the official Five Nights at Freddy's trailer now.

Teenage Mutant Ninja Turtles: Shredder’s Revenge Dimension Shellshock Launches on Aug. 31 Alongside Free Update, Reveals Foot Clan Outlaw Karai as a Playable...

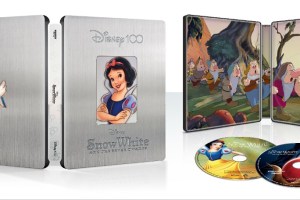

This will be the first time that the classic film Snow White and the Seven Dwarfs has been made available in 4K UHD ...

Three brand-new full-cast audio dramas are released today, as The Sixth Doctor Adventures: Purity Unbound box set brings down the curtain on the latest series...

The eagerly anticipated retro-inspired RPG Sea of Stars launches Aug. 29 ...

Ready to binge a return journey to Storybrooke?

In the Star Wars: Ahsoka end credits theme, you'll definitely recognize the title character's signature theme from Clone Wars and Rebels ...

The Monsters! Monsters! roleplaying game is getting a rules update with new adventure scenario material for both game masters and solo players ...

Disney+ debuts a stunning new restoration of Walt Disney’s 1950 animated classic “Cinderella” during World Princess Week, as part of its centennial salute to...

Gils, the in-game gold of the Final Fantasy 14 world, play a special role in pumping and shaping the character’s strength and equipment ...

Excitebike 64 packs an entire stadium full of showstopping stunts and oil-charged action into one classic package.

In the Western U.S., cities with finite water supplies are finding creative new ways to stretch out the water they already have. For some, that means cleaning...

Gran Turismo: Based on a True Story surprises on several levels ...

Today, Disney+ shared “Rebel Crew,” an exciting new featurette, to celebrate the launch of Lucasfilm’s newest series “Star Wars: Ahsoka,” which began streaming...

All good things come to an end and River’s run of audio dramas is going out with a bang in The Orphan Quartet box set ...

A classic is coming back in a partnership between PLAION and Atari: Revisit retro titles with the Atari 2600+, a console that brings new life to one of...

Investigating banditry leads to the discovery of a horrifying plot threatening the existence of Phandalin in the return of this beloved D&D adventure setting ...

Xbox 360 online game sales won't live to see 20 ...

Mr. Martinet, we salute you ...

The two-episode premiere of Ahsoka will now arrive on Tuesday, Aug. 22 at 6 p.m. PT on Disney+ ...

Blue Beetle stands alone in that it is better and more fun that most of its previous film brethren – and that’s good.

"Keep your lid on, Chop!"

Kikori Con will be one week earlier next year, March 8-10 …

Adventure Time: Fionna & Cake premiers Aug. 31 on Max ...

Red Dead Redemption is available on new platforms ...

This makes the first third-party or "partnered" content on the digital official toolset for the Dungeons & Dragons roleplaying game.

A remastered Quake II is available now on PC, Xbox One, Xbox Series X/S, PlayStation 4, PS5 and Nintendo Switch ...

Sergio and the Holograms is the brainchild of musician Sergio Elisondo, who strives to push the limitations of retro gaming technology.

The 60th anniversary audio adventures continue in the latest episode of Big Finish’s celebratory Doctor Who story, Once and Future ...

Look back at the beginning of Lucasfilm Animation and how Star Wars: The Clone Wars came to be ...

Shihori Nakane is a prolific singer, songwriter, and composer. She discusses her challenges, hopes, and style moving forward as an artist in America.

What can you expect in the new animated film Babylon 5: The Road Home?

Stranger Things: The Voyage #1 (of 4) sets sail on Nov. 1, 2023.

Dive into the new Star Wars master-apprentice legacy with the cast and filmmakers of Ahsoka ...

Downtown Phoenix was taken over by the Game On Expo at the Phoenix Convention Center.

Some of the guests announced for that show include Roger Craig Smith (Sonic), Patricia Summersett (Legend of Zelda), and Aaron Dismuke (Full Metal Alchemist).

This week you can catch Voyage Trekkers creator Squishy Studios' latest film, The Last Movie Ever Made, online.

My Maker Mantras

The Second Doctor’s partially missing adventure will be animated with four new episodes in colour and high definition, releasing on DVD and Blu-ray.

Does The Last Voyage of the Demeter suck?

Watch Ahsoka Tano give Ezra Bridger a lesson in finding his inner strength and trusting in the Force ...

Ex-Mesa comic shop owner Anthony Gushee was sentenced to prison in June on reduced charges in the fatal shooting of Aaron James Miller ...

The Game On Expo 2023 is coming up, here's five things you should add to your schedule while there!

Pokemon classics come from Game Boy Color and Nintendo 64 to Switch via the Nintendo Switch Online services ...

Once a rebel, always a rebel ...

Disney’s live-action reimagining of the studio’s Oscar-winning animated musical classic “The Little Mermaid” will premiere on Disney+ Sept. 6, 2023.