Nerdvana Media Services

WE ARE CONTENT …

Smart, fun content that engages readers and consumers …

- 112 Things I Love About Arizona

- Love at first sight: What video game made its system irresistible for you?

- New D&D core rulebooks coming – but when?

- Big Finish adapts vampy 1994 Doctor Who novel Goth Opera for audio

- Nerdvana’s most anticipated video games of 2024

- Final season of The Bad Batch starts Feb. 21 with 3 episodes on Disney+

- Big Finish Doctor Who audio drama releases

- Doctor Who: The Collection – Season 15 brings 1977 stories to Blu-ray

- ‘Mandalorian & Grogu’ movie filming this year; Ahsoka Season 2 also in development

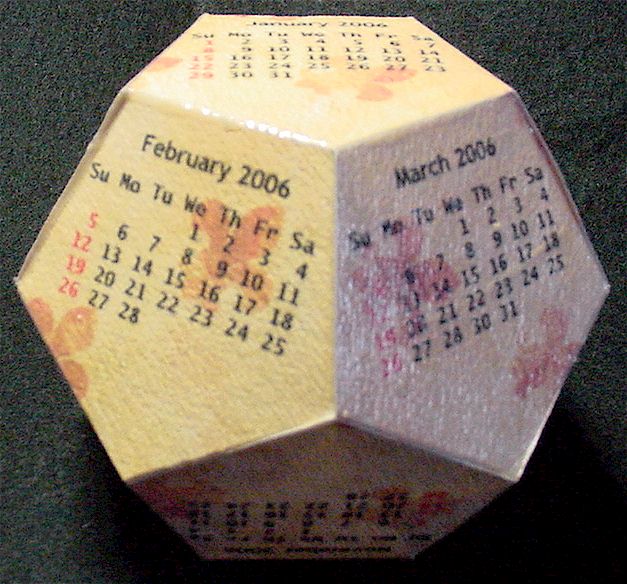

- Papercraft calendar: Roll up 1d12 months of 2024

- Follow Nerdvana on Threads

- Watch the Dune: Part Two trailers

We feed your need.

We can provide syndication as a solution, delivered how you want it.

WE ARE MORE THAN CONTENT …

Services for your site:

- Blogging – tailored content, ghostwriting

- Email newsletters (automated feed or handcrafted)

- Social media management

- On-site SEO

- Ad creation and distribution

- Google Adsense and/or DFP ad serving

WordPress-specific services:

- Training/documentation

- Platform integrations with Google AMP, Google News, Facebook Instant Articles, Apple News, Flipboard, MailChimp and more

- Social media automation – post when you publish

- Event calendar listings

- Automatic backups

- Plugin evaluation

- Theme updates

- Basic customization

- Surpassing “that WordPress look”

- Copywriting and polishing – ditch the boilerplate (Goodbye, “Hello World!”)

- Google Analytics reporting setup

- Google Search Console (Webmaster Tools) monitoring setup

- Ad system setup, management and training

- Portfolio/resume formatting and site builds

Looking to advertise on Nerdvana? We can do that, too! (Media kit available)